In 2024, SaaS spending is skyrocketing, set to hit $243.99B, per Gartner. Leaders like Monday.com and Asana, channeling over 50% of revenue into sales and marketing, spotlight the need for sharp promotional tactics in a cutthroat market.

For SaaS entrepreneurs, the battle isn't just about funding ads—it's about wise investment. Echoing John Wanamaker, "Half the money I spend on advertising is wasted; the trouble is I don't know which half," the key is dodging fruitless spending.

Against this backdrop, we're diving into seven groundbreaking SaaS growth strategies for 2024. Our guide aims to turbocharge your SaaS business’ growth, steering you clear of setbacks and accelerating success in this fast-paced industry.

7 Innovative B2B SaaS Growth Strategies for Your Business in 2024

With over 17,000 SaaS companies in the U.S. and a global customer base of 59 billion generating $401.6 billion in revenue, the competition is fierce.

Staying ahead requires more than just a great product; your growth strategies must be sharp and effective to attract customers. Here are the top 7 SaaS growth strategies for your business's success this year.

1. Allow Customers to Pay on their Own Terms

Many SaaS companies offer multiple pricing plans, but they may not always align with each customer's needs. Failing to offer a suitable plan can jeopardize closing a deal.

To address this challenge, consider adopting a flexible, customer-centric strategy, such as adding Buy Now, Pay Later (BNPL) options during checkout.

B2B BNPL, which allows customers to buy now and pay later in installments, is becoming a norm. It divides the total cost into smaller, more manageable payments, making it appealing to those who prefer not to pay a large upfront amount.

Imagine your SaaS customer balking at a $23,520 upfront cost—$3,960 annually for the product plus $19,560 for initial services. It's out of their budget. To keep the deal alive, you propose an easier route: $879 monthly over three years. They bite.

But there's a catch: losing that upfront cash hits your working capital. Here’s the fix: team up with B2B BNPL (Buy Now, Pay Later) providers like Ratio. They pay you upfront, while your customer settles with Ratio according to the desired payment plan. Everyone wins.

SaaS businesses can reap numerous benefits by offering such payment flexibility:

1. Increased Conversion Rates: Offering this accessible payment option attracts a broader customer base, including budget-conscious individuals.

2. Enhanced Customer Satisfaction: Flexible payment plans enhance the overall customer experience, resulting in higher satisfaction and loyalty.

3. Lower Customer Acquisition Costs: Offering payment flexibility instead of offering discounts to close deals ultimately reduces the cost of acquiring customers.

Pitfalls to Avoid

While BNPL offers numerous benefits, there are potential pitfalls:

- Overcomplicated Payment Processes: Opting for a do-it-yourself route in B2B BNPL can overwhelm your accounting team and complicate matters. A B2B BNPL service that doesn't seamlessly integrate with your sales workflow may turn off customers. The key lies in selecting the ideal B2B BNPL provider for smooth operations.

- Lack of Transparency: Trust and transparency are paramount in BNPL operations. Customers often face uncertainty about BNPL mechanics. It's vital to provide clear, straightforward information on how BNPL functions, detailing terms and conditions to foster understanding and confidence.

2. Don't Let Your Growth Initiatives Make a Dent in the Cash Flow

Balancing growth and maintaining healthy cash flow poses a critical challenge for B2B SaaS companies for two primary reasons:

- The unique business model of SaaS firms, centered on recurring revenue rather than one-time sales, spreads the payments in smaller chunks over long durations.

- Traditional financing often worsens this issue, leading to cash flow constraints. These lenders typically require collateral or consistent cash flow patterns, which early-stage or rapidly scaling SaaS companies may lack. This misalignment can hinder their ability to secure the necessary funds for growth.

To address these challenges, Revenue-Based Financing (RBF) and True-Sale Based Financing (TBF) offer flexible and growth-friendly solutions.

RBF allows companies to secure funds by pledging a portion of their future revenues. This approach benefits SaaS businesses by tying repayments to revenue performance, thus simplifying financial management during slower periods. RBF stands out as a flexible and scalable option for B2B SaaS firms.

In contrast, TBF involves selling future revenue streams in exchange for immediate capital. This method provides liquidity without the conventional constraints associated with debt.

Case Study: Nextech3D.ai's Funding Success

Illustrating the effectiveness of these innovative financing methods is Nextech3D.ai's funding journey, as reported by Yahoo Finance.

Nextech3D.ai secured $2 million from RatioTech, a significant player with a $411M fund. This funding utilized a combination of RBF and TBF, demonstrating how SaaS companies can leverage these methods for substantial growth funding without experiencing the typical cash flow strain or equity dilution associated with traditional loans.

Pitfalls to Avoid

While these financing methods offer promise, it's crucial to be aware of potential pitfalls. Insufficient knowledge of RBF can lead to unfavorable terms, and high financing fees pose a risk.

To mitigate these risks, partnering with knowledgeable and well-funded firms like Ratio is essential, as they can offer tailored financing solutions that align with the unique needs of SaaS companies.

3. Don't Make This Mistake in ABM

In the SaaS industry, Account-Based Marketing (ABM) is pivotal for growth. A crucial mistake to avoid is underutilizing Artificial Intelligence (AI) in your ABM strategy. AI integration can significantly enhance the effectiveness of your ABM campaigns.

1. AI-Driven Personalization: Utilize AI to analyze data and create highly personalized content for each target account, addressing their unique needs and preferences.

2. Predictive Analytics for Targeting: Employ AI-powered analytics to identify high-potential accounts and focus resources on those most likely to convert, improving targeting accuracy.

3. Campaign Automation and Optimization: Use AI to automate and continuously optimize ABM campaigns, ensuring they adapt in real-time for maximum impact.

4. Enhanced Lead Scoring: Integrate AI for a more dynamic and accurate lead scoring system, prioritizing the most promising leads effectively.

5. AI and CRM Integration: Combine AI tools with your CRM system for a unified approach, enabling seamless information flow and a comprehensive view of target accounts.

Common Pitfalls to Avoid

Effective AI in ABM requires high-quality data. Regularly update and clean data sources to ensure AI algorithms produce accurate and effective targeting.

Additionally, seamless integration between AI tools and systems like CRM is essential for effective ABM. Proper integration ensures consistent data utilization, enhancing targeting and personalization.

Moreover, successful AI implementation in ABM depends on user proficiency and acceptance. Provide comprehensive training and foster a culture that embraces AI, encouraging team members to engage with and provide feedback on AI tools, ensuring optimal use and ongoing improvement.

4. Don't Miss Out on Buyers with Credit Cards in their Hands

Engaging potential customers on the brink of a purchase decision in the B2B SaaS market requires a sharp, focused blogging strategy.

Bottom-funnel articles play a key role in this strategy. By featuring product comparisons, highlighting top choices, and offering direct matchups, these articles assist customers in their final decision-making phase.

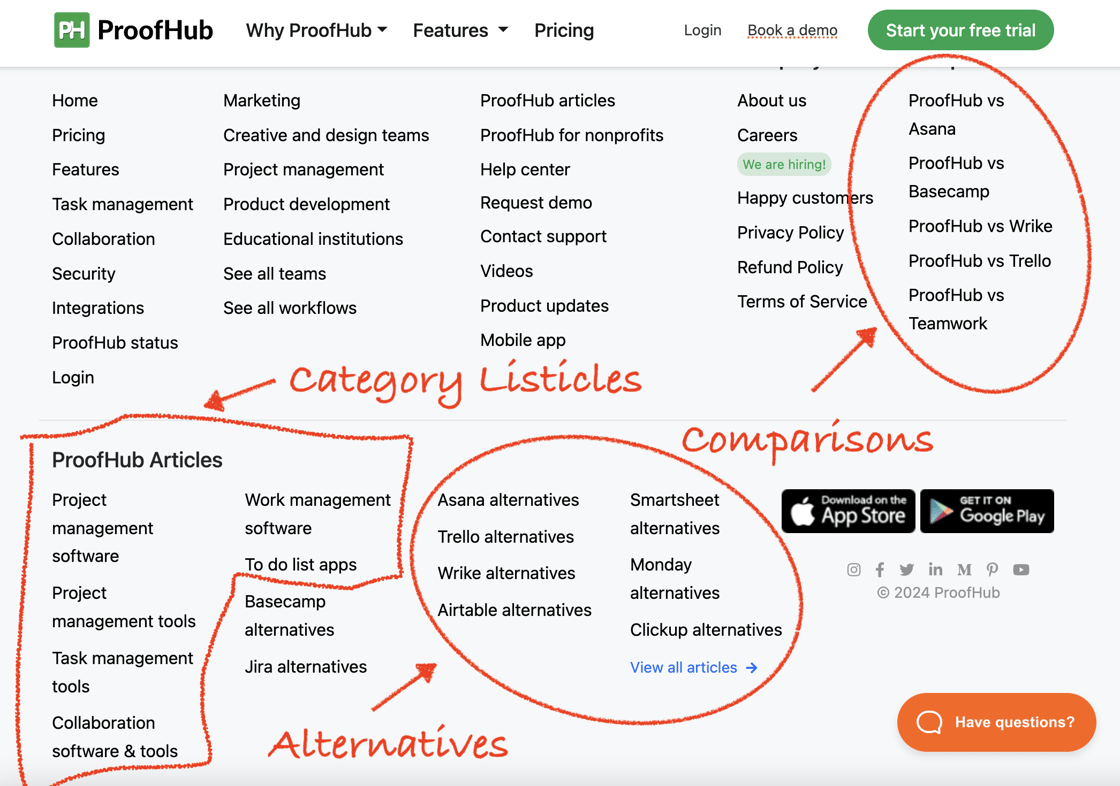

ProofHub has Nailed this Approach

ProofHub's strategy exemplifies this methodology. Their articles not only present top SaaS products but also engage in direct comparisons like 'SaaS A vs. SaaS B'.

This approach, targeting buyers nearing their purchase decision, showcases ProofHub's confidence in its offerings and aids customers in evaluating their options.

Pitfalls to Avoid

Crafting a compelling blog for your SaaS business is a fine art, and it's critical to dodge two common traps: producing surface-level content and hesitating to spotlight your product in listicles.

To vault over these hurdles, pour your energy into developing content that's not just well-researched but also deeply engaging and thorough. Don't just lean on your product's website for info; dive into the vibrant world of influencer videos, user forums, and beyond. Give your blog an edge with a mix of demo videos, insightful case studies, strategically placed calls-to-action (CTAs), and FAQs.

Remember, the heart of a winning blog strategy in the B2B SaaS arena is aligning with your audience's needs and decision-making processes. When you nail that, you're not just sharing content – you're guiding potential customers down the path to conversion.

5. Don't Tell Them What Your SaaS Does

When crafting a bottom-of-the-funnel article for your B2B SaaS, it's crucial to focus not just on what your software does but on how it benefits the user. This approach shifts the spotlight from features to value, ensuring your message resonates with your target audience.

Real-Life Example

Let's see how a renowned SaaS platform like Slack applies this approach. Instead of just listing features like real-time messaging or file sharing, Slack's marketing emphasizes how these features enhance team communication and productivity. This approach makes the benefits tangible and relatable for potential customers.

Pitfalls to Avoid

When discussing the benefits of your SaaS product, it's crucial to steer clear of certain common mistakes.

A significant pitfall is the use of vague messaging that fails to clearly convey the specific benefits of your SaaS. This lack of clarity can prevent potential customers from understanding the advantages of choosing your solution over others.

To effectively communicate the benefits of your SaaS, consider the following approach:

- Focus on Specific Benefits: Directly address how your SaaS improves the user's life or business. Be explicit about the advantages your product offers.

- Translate Features into Benefits: Don’t just list features; explain how these features translate into real-world benefits for the user.

- Use Clear, Concise Language: Avoid jargon and complex language. Your message should be easily understandable to ensure it resonates with your audience.

- Tailor Benefits to Your Audience: Understand your target audience's needs and pain points and highlight the benefits that are most relevant to them.

- Employ Compelling Narratives: Stories can be a powerful tool. Weave the benefits of your SaaS into engaging narratives that connect emotionally with your audience.

- Regular Evaluation and Refinement: Continuously assess and refine your messaging based on feedback to ensure it remains effective and relevant.

By adhering to these strategies, you ensure that your communication is centered around the tangible benefits your SaaS provides. This approach not only clarifies the value of your product to your audience but also reinforces the importance of focusing on how your software enhances the user experience.

Remember, the key is to consistently highlight how your SaaS makes life better for your users, keeping the spotlight firmly on the benefits.

6. Come Up with Viral Marketing Campaigns

Developing viral marketing campaigns is a pivotal strategy in B2B SaaS marketing, where the goal is to create content that your audience feels compelled to share.

A successful campaign hinges on crafting a narrative that not only showcases your product but also emotionally engages your audience. This connection turns your brand into something memorable and share-worthy.

When your audience relates to your story, they're more likely to spread the word, amplifying your reach organically. This method of marketing is not just cost-effective; it also lends authenticity to your brand, as peer-to-peer sharing often holds more weight than traditional advertising methods.

Example of a Viral Marketing Campaign: Zoom's Strategy

Consider Zoom's "Virtual Background Challenge," initiated in March 2020, as a prime example of a viral marketing campaign done right. This monthly contest encouraged users to utilize Zoom's virtual background feature creatively. The campaign quickly gained traction, with over 50,000 participants engaging in this innovative use of a standard feature.

This campaign did more than just entertain; it engaged users in a way that highlighted Zoom's features, driving both user engagement and attracting new customers.

It's a clear demonstration of how interactive and user-centric marketing can be a game-changer in the SaaS sector.

Pitfalls to Avoid

Crafting successful viral marketing campaigns involves avoiding key pitfalls and implementing strategic solutions.

One major pitfall is creating overly complex or confusing content, which can quickly lose your audience's attention. The solution is straightforward: opt for clear, simple language and visuals. This approach ensures your message is easily understood and more likely to engage and be shared by your audience.

Another critical aspect is the accuracy of audience targeting. A campaign that fails to resonate with its intended demographic is likely to fall flat. To prevent this, it's essential to use data analytics to thoroughly understand your audience's preferences.

By tailoring your content to align with your audiences’ interests, you ensure your message is relevant and impactful. This targeted approach not only enhances the relevance of your content but also significantly boosts the likelihood of your campaign's success.

While effective marketing strategies are key to attracting customers, it's just as important to consider the financial support needed to scale these operations. Solid marketing can drive business growth, but it requires the right resources to fully realize its potential.

How Can Ratio Help You Grow Your SaaS Business?

Many B2B SaaS companies, while having solid growth ideas, fall short on cash to fuel their growth strategies. Financing partners like Ratio can come to the rescue if these companies can demonstrate potential revenue growth.

Ratio offers two attractive financing solutions - Boost - Revenue Based Financing (RBF) and Trade - True Sale Based Financing (TBF).

Boost, trusted by renowned companies like Bigtincan and Sorting Robotics, is revolutionizing the SaaS sales landscape. Our embedded closing platform lets you provide customized payment options to your customers, ensuring you get paid upfront regardless of the customer's payment choice.

Trade offers a practical solution for funding your business by leveraging your existing contracts. Convert your contracts into immediate cash with Ratio. Pay Ratio only when your customer pays, with no required monthly payments for up to 12 months.

Register on Ratio’s easy-to-use app to see how it can transform your financial management and bolster your growth strategies.

Frequently Asked Questions

Here are some frequently asked questions about SaaS growth strategies.

1. What is a SaaS growth strategy?

A B2B SaaS growth strategy combines marketing efforts to increase customer acquisition and expand product reach. This strategy blends paid, organic, and inbound marketing to generate leads and turn them into paying customers.

2. What is the rule of 40 in SaaS?

The Rule of 40 is a guideline for software companies. It means that the revenue growth rate and profit margin should add up to at least 40%. If it's above 40%, the company is making a good profit. If it's below 40%, they might have money problems.

3. How to measure your SaaS growth strategy’s impact?

When evaluating business growth metrics for SaaS companies, concentrate on these essential aspects:

1. Revenue and Profits: These metrics signify business success. Set targets for ARR, MRR, ARPU, and net profit to maintain consistent growth and profitability.

2. Customer Acquisition and Retention: Assess customer acquisition to measure the effectiveness of marketing, sales, and product development. Concurrently, monitor retention rates to nurture existing customer relationships.

3. LTV/CAC Ratio: Compare customer lifetime value (LTV) to customer acquisition cost (CAC) to gauge the value acquired relative to customer acquisition expenses.

4. Churn Rate and Customer Satisfaction: Evaluate churn rate to monitor customer subscription cancellations and product discontinuations. Also, consider metrics like Net Promoter Score (NPS) for insights into customer sentiment and loyalty.

5. Market Share and Competitive Position: Analyze your market share and competitive stance to understand how your growth strategy impacts your competitive edge and market leadership.

4. What should be included in my SaaS growth strategy?

A strong SaaS growth strategy should focus on the following:

- Business Objectives: Define your long-term vision and align your short-term goals with it.

- Product-Market Fit: Understand your target market and ensure your product addresses its needs. Be ready to tweak your product and ideal customer profiles (ICPs) as needed.

- Marketing and Sales: Refine your targeting and key performance indicators (KPIs). Enhance your marketing and sales processes for better efficiency.

- Internal Operations: Eliminate unnecessary projects, processes, and personnel to streamline operations.

- Logistics and Infrastructure: Address any issues in storage, security, and supply chain to avoid bottlenecks.

- Customer Communication and Support: Continuously look for ways to improve the customer experience.

- Product Functionality: Regularly update your product to fix issues and enhance successful features.

- Financials: Review and adjust financial goals. Focus on metrics and processes that are realistic, comprehensive, and useful.

5. What are the benefits of Buy-Now-Pay-Later (BNPL) for B2B?

B2B BNPL offers notable advantages for businesses. It streamlines sales cycles, boosts Annual Recurring Revenue (ARR) and Average Contract Value (ACV), lowers customer acquisition costs (CAC), and minimizes churn.

Additionally, it ensures steadier cash flow and cuts down on time spent managing billing and payments, which is particularly beneficial for SaaS companies.