What Difference Does it Make to Offer Payment Flexibility With and Without a B2B BNPL Partner?

Are you offering payment flexibility to your customers all on your own?

It’s time to rethink.

When you offer it on your own, you bear the burden of delayed payments, operational strain, and financial risk.

However, when you offer payment flexibility with a B2B BNPL partner, you get upfront capital, streamlined operations, and reduced risk.

Not just that, a partnership with a B2B BNPL partner could be a way to meet your revenue goals. Wondering how? Our funding comparison calculator can give you a clear idea—let’s dive in!

If you’re exploring flexible payment solutions, you’ll want to discover the 5 key benefits of offering B2B Buy Now, Pay Later to enterprise clients.

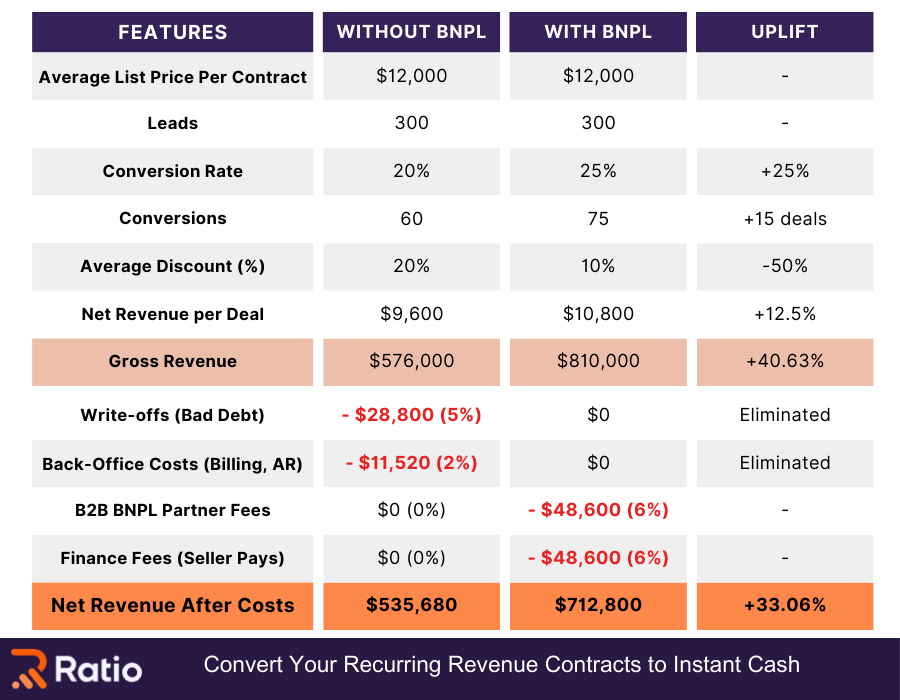

A Clear Comparison: Revenue Impact With and Without B2B BNPL Provider

To illustrate how the revenue numbers get impacted with and without a B2B BNPL partner, we have made two assumptions, keeping a typical B2B SaaS business in mind—for SaaS teams, Boost for SaaS is tailored to these dynamics:

- Average ideal size–$12,000

- Number of deals chased over a year–300

While exact metrics like deal sizes and percentages may vary across businesses, the difference between these two approaches remains consistent.

Here’s how the two approaches measure up:

Here’s how structured BNPL transforms SMB buyer experience and seller outcomes.

What Do the Numbers Tell Us?

The numbers reveal how B2B BNPL partnerships transform payment flexibility into real results.

While the starting point—leads and contract value—stays the same, B2B BNPL drives meaningful improvements in key areas like conversion rates, discounts, and overall revenue—and you can model these dynamics with our C2C simulator.

Here’s how the two approaches compare:

Higher Conversions with B2B BNPL Provider

- Without a B2B BNPL provider, the conversion rate is 20%—limited by customers’ inability to pay upfront or secure manageable payment terms.

- With a B2B BNPL provider, the conversion rate rises to 25% because customers are offered highly flexible payment options that align with the unique business settings of the customer, making it easier to close deals.

Lower Discounts Needed with B2B BNPL Provider

- Without a B2B BNPL provider, sales teams must rely on steep discounts (20%) to secure upfront payments.

- With a B2B BNPL provider, the discount drops to just 10% because customers can spread payments over time. Think of it as a barter for payment flexibility.

No Write-Offs or Back-Office Costs with B2B BNPL Provider

- Without a B2B BNPL provider, businesses lose 5% of revenue to bad debt write-offs and spend 2% on back-office costs like collections and account management.

- With a B2B BNPL provider, these costs are eliminated because the provider takes on the risk and handles collections.

Fees for B2B BNPL Partnerships

- While B2B BNPL providers eliminate bad debt and operational costs, they introduce platform and finance fees (6% each).

- Even after accounting for these fees, the net revenue uplift remains substantial.

Final Thoughts

Clearly, the numbers make a strong case—by partnering with a B2B BNPL provider; you can boost revenue by 20%-40% and significantly reduce operational headaches. Now is the time to explore how B2B BNPL partnerships can transform your payment strategies and grow your business.

.png)