Ratio Emerges From Stealth; Secures $411M to Transform B2B SaaS Payments, Financing, and Pricing

Team of serial entrepreneurs, SaaS, and finance executives unveil revolutionary BNPL for SaaS businesses — a boon in these turbulent times

Ratio, a new kind of fintech platform that combines financing, payments, predictive pricing, and a frictionless quote to cash process into one platform for SaaS and technology companies, today emerged from stealth and announced raising $11M in venture funding and a $400M credit facility for customer financing. Led by a team of industry veterans, Ratio is rewriting the rulebook for SaaS pricing and financing, driving value for vendors by delivering a new set of tools to accelerate growth in the turbulent market.

The subscription economy is now a $1.5 trillion segment of the recurring revenue market, with industries ranging from software to razor blades deploying subscription-based business models — but companies still face challenges with deferred cash flow, steep discounting, and the time needed to recoup customer acquisition costs, even as customers’ desire for payment flexibility is growing more ubiquitous. The current cash flow crunch has only exacerbated this problem. That’s where Ratio comes in: its game-changing platform allows SaaS companies and other recurring revenue businesses to provide embedded buy now, pay later (BNPL) services that granularly match their customers’ cash flow needs. This provides ultimate flexibility to the customer, while boosting sales for vendors and giving them immediate access to the value of the customer contract.

Simultaneously, Ratio allows SaaS businesses to leverage their recurring revenue streams to unlock instantaneous new non-dilutive capital — without having to give up additional equity, dilute control of their business, steeply discount their products or spend countless hours in an always-be-fundraising mode. Ratio’s platform is built around two powerful core products:

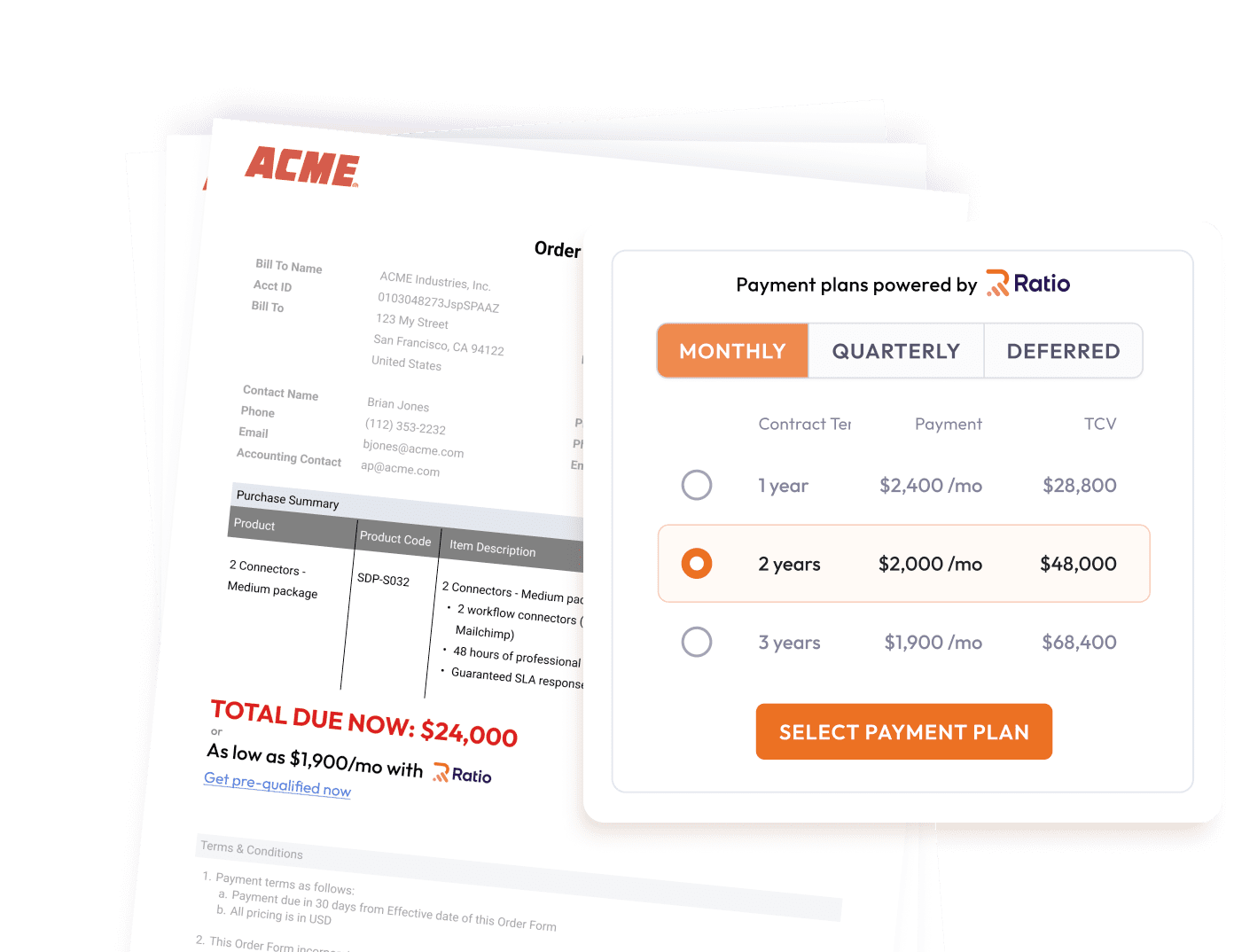

- Ratio Boost, a fully integrated BNPL payment, optimized pricing, and checkout product, embedded via API into the seller’s systems and processes at the point of sale. Customers get ultimate payment flexibility, by matching their cash flow needs, and a frictionless buying experience automatically tailored to their company’s unique needs, while vendors get paid cash upfront for each customer contract, minimizing discounting and dilution. Better yet, by applying machine learning to financial and behavioral data, Ratio Boost can validate and optimize product pricing and payments for churn risk, lifetime value, and willingness to pay.

- Ratio Trade, a non-dilutive upfront capital solution for high-growth SaaS and recurring revenue companies backed by their portfolio of contracts. With Ratio Trade, vendors no longer have to discount their offerings or dilute equity to access working capital — and they can access financing in days, not months, to keep growing their brands.

Must explore: The 5 ways B2B SaaS can accelerate ARR growth

Together, Ratio’s technologies offer a compelling solution for both SaaS vendors and SaaS buyers in today’s increasingly cash-constrained environment. With 80% of SMB buyers expecting a recession this year, the ability to streamline payments over time and maintain a cash operating buffer makes software purchases far easier to justify. For enterprise buyers, with budgets tightening, BNPL solutions enable easier purchasing decisions for IT purchases. And with funding for the SaaS sector now waning, Ratio’s solution enables vendors to boost sales, maximize revenues, and reduce the need for costly discounting in order to finance their growth.

Ratio’s founders and management team have deep roots in the SaaS and technology spaces, with proven experience building large software businesses and early stage companies. Together, they created Ratio to solve the challenges they themselves experienced running major SaaS businesses and startups. Founder and CEO, Ashish Srimal, has held executive positions at SAP and Medallia. He was also previously the founder and CEO of SmarterMe, the world’s first intelligent mobile assistant for sales, and has advised numerous SaaS, venture, and private equity firms. Cofounder and CTO Mason Blake also co-founded UpCounsel, the world’s first B2B legal marketplace, where he served as CTO and eventually as CEO. The company later exited to LinkedIn where he led the service marketplace team before founding Ratio.

Additionally, Chief Commercial Officer Carlos Chou held senior executive and revenue leadership positions at SAP, Hewlett-Packard, Oracle, and notably at Siebel Systems, where he served as President prior to the acquisition by Oracle. And Chief Risk Officer Sai Uppuluri is an 18-year industry veteran with extensive experience leading risk, analytics, and structuring operations for major fintech companies and financial institutions including Standard & Poor's, OnDeck, and SaaS fintech leader ODX.

Ratio’s investors include Streamlined Ventures, Cervin Ventures, 8-Bit Capital, HoneyStone Ventures, multi-billion dollar asset managers and a range of tech CEOs from both large and small companies.

For SaaS vendors, Ratio’s offerings mark a new era in intelligent, effective, and customer-centric pricing — and a powerful new approach to raising non-dilutive growth capital.

"We believe deeply in transforming buyer experiences. Ratio is further extending the buyer experience into the closing experience. With Ratio Boost we see many ways for SaaS companies to sell more deals faster - we do it by speeding up the procurement process for our customers,” said David Keane, CEO of Bigtincan.

“We created Ratio to revolutionize the way that SaaS companies and technology businesses price, get paid and fund their growth,” said Ashish Srimal, Ratio cofounder and CEO. “Payment flexibility, intelligent and iterative pricing, combined with a frictionless quote to cash process is the new strategic frontier for SaaS growth. We use data, machine learning, and finance as tools to unlock this growth lever for our customers. This creates a win-win for both tech buyers and sellers — buyers get more payment flexibility to match their cash flow and procurement constraints, and sellers get more revenue acceleration tools. Our mission is to democratize the way that we buy, sell, and fund technology. We imagine a world where every buyer and seller of technology — no matter whether they’re in New York or Nairobi — has access and opportunity to buy and build the best. In short, we help accelerate and democratize the way that software eats the world.”

"We think Ratio is a game changer for SaaS companies. The way it uniquely combines finance, pricing, and an intelligent checkout flow in a simple and elegant solution has not been seen before in SaaS. The solution not only increases the speed to close and drives higher ACV/TCV, but enables much needed improved cash flow for high growth tech companies,” says Ullas Naik, General Partner at Streamlined Ventures. “Ratio is on the forefront of two critical trends; first, the ability for SaaS companies to leverage their recurring revenue to their benefit and second, embedded intelligent sales and finance tools to enable greater efficiency. Ratio gives companies a new and powerful strategic lever to accelerate growth.”

About Ratio

Led by a team of serial technology entrepreneurs and SaaS and finance veterans, Ratio is a new type of buy now, pay later (BNPL) provider and financing platform for recurring revenue businesses across three continents. Founded in 2021, Ratio brings a new flavor of BNPL services that combines payments, predictive pricing, analytics and finance, allowing B2B SaaS firms and other recurring revenue businesses to boost sales while gaining immediate access to the value of new contracts.

In addition, Ratio allows technology companies to leverage their recurring revenues to unlock new financing without diluting equity or surrendering control of their business. With access to a $400 million credit facility, Ratio is rewriting the rulebook for the global subscription economy and recurring revenue businesses.

You can read more about us in TechCrunch.

.png)