Capchase Competitors and Alternatives for Revenue-Based Financing

Quick compare -> Evaluating Capchase? Read our head-to-head: Capchase alternative: why teams choose Ratio

Capchase is a prominent Revenue-Based Financing (RBF) platform; if you’re evaluating it, start with this Capchase alternative comparison (Ratio BNPL & Revenue Accelerator Platform), then review other options below.

While Capchase is a good option, it has become prudent for many new SaaS and hardware businesses to explore alternatives. Companies are seeking more flexible options, possibly due to Capchase’s stringent lending criteria, limited geographical reach, and RBF's market expansion.

In this post, we have comprehensively covered the top three Capchase alternatives: Ratio, Vartana, and Pipe, to assist you in informed decision-making.

3 Promising Capchase Alternatives

Besides offering an RBF solution called Ratio Boost, Ratio steps beyond the norm in RBF, pioneering a platform that turns your recurring revenue contracts into immediate cash—no strings of warrants or dilution attached with its solution called Ratio Trade.

Vartana shines with its custom solutions suitable for individual business needs, data-driven underwriting processes for fair deals, and transparent information about fees and terms.

Pipe, on the other hand, enables businesses to convert predictable revenue into working capital through secure, live data connections, thus providing funds when needed most.

As we progress, we will explore each solution in more detail to ease your selection and carve the pathway to access the well-deserved and much-needed capital.

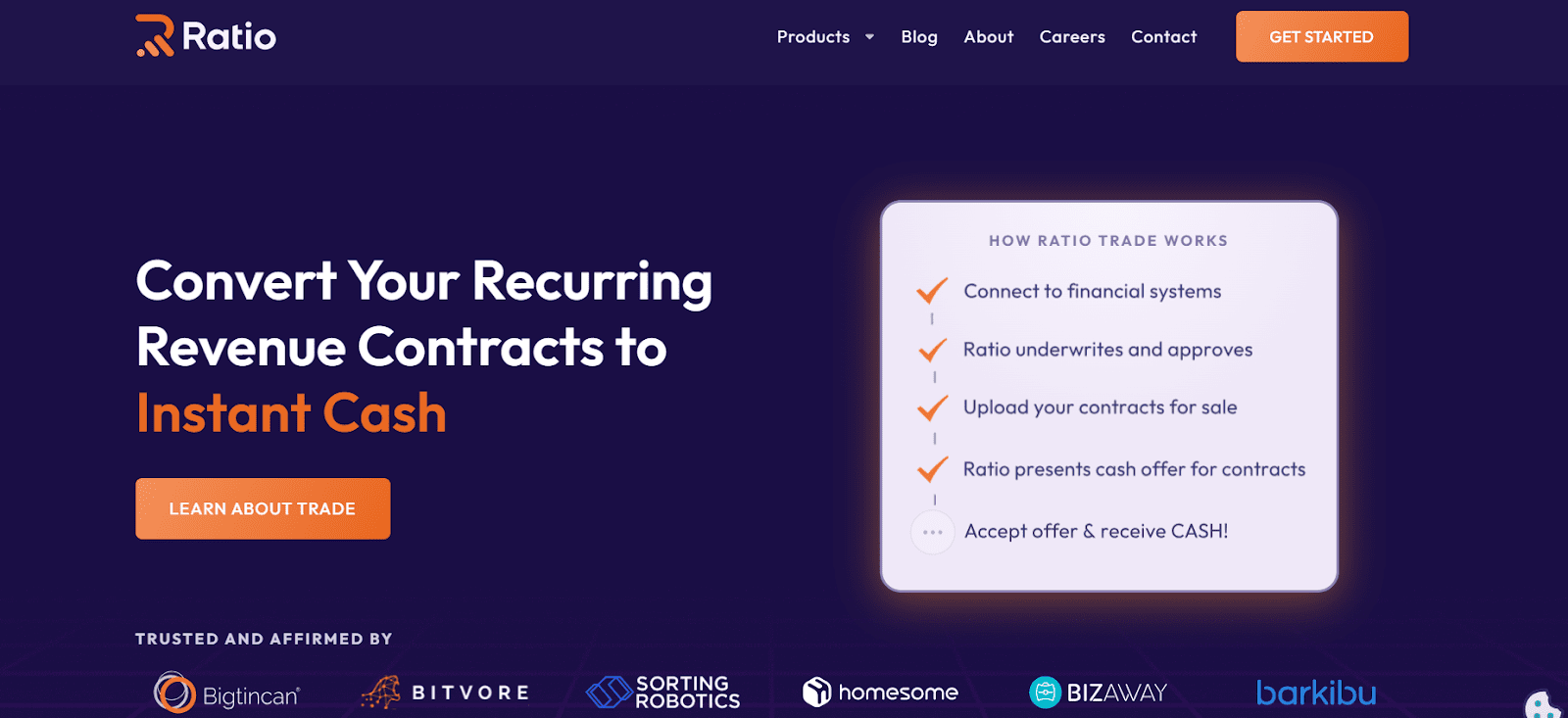

Ratio

Ratio quickly turns your recurring revenue contracts into instant cash without any debt, interest costs, or dilution. With Ratio, you can get cash from your contracts today, freeing you up to focus on growth. It's simple, quick, and designed with your business needs in mind.

Ratio caters to the diverse needs of businesses with their two product options: Boost and Trade.

Key Differentiators

Besides no-strings-attached revenue-based financing, flexible payments terms for your customers, and easy-to-use interfaces, here is what sets Ratio apart:

- Access to substantial capital: ~$400M credit facility for customer financing

- Instant cash generation: Businesses can generate immediate cash by leveraging their recurring revenue contracts today.

- Robotics-as-a-Service Facilitation: Robotics companies face a high demand for capital, and their customers increasingly seek the flexibility of subscription-based payments. To meet these needs, Ratio Boost assists these firms in effectively implementing the Robotics-as-a-Service model.

Check out how Nextech3D.ai, an AI-focused 3D model supplier, has tapped into $2 million of non-dilutive funding via Ratio. This investment against future invoices facilitates Nextech3D.ai's growth, boosting financial flexibility without surrendering equity.

Ratio Boost

Boost caters to SaaS and hardware businesses that offer Buy Now,Pay Later (BNPL) flexibility to their customers.

Moreover, It effortlessly incorporates finance costs into the everyday flow of sales activities. To make the process even smoother, businesses can integrate Boost directly into their website or seamlessly incorporate it into their CRM and CPQ sales procedures.

Payment Terms

Boost offers sellers flexible buyer payment plans with three options:

- Seller Pays: Seller can absorb financing costs to keep customers happy.

- Buyer Pays: It lets Ratio handle balance sheet risk while providing payment flexibility to customers.

- Split 50/50: Seller can balance cash flow constraints and customer retention by sharing fees with buyers. The fee structure can be customized to suit the seller's situation.

Benefits

Boost empowers businesses to amplify revenue with the following:

- Reduces risks through handling balance sheet risk.

- Enhances visibility with dynamic underwriting.

- Decreases buyer friction with flexible payment terms, thus helping SaaS and hardware companies win more customers.

Must Read: 5 Compelling Reasons for B2B SaaS Firms to Opt for Revenue-Based Loans

Ratio Trade

Ratio Trade allows companies to turn annual and multi-year contracts into quick cash without taking on debt or diluting shares. The approval takes 48 hours, and funds reach your bank account within days.

How Does it Work?

Trade can help you get cash in five steps:

- Through the Ratio Portal, connect your banking, financial, and billing systems.

- Get approval or decline within 48 hours.

- Upload multi-year or annual contracts.

- Receive a cash offer indicative of its value for each contract.

- Get cash in your account after accepting the offer.

Payment Terms

With Ratio Trade, cash-generating assets are sold to Ratio in exchange for purchase consideration.

It charges a discount rate for this consideration. The discount rate is determined by the length of the contract, level of risk, and advance repayment schedule. The rate can range from 1% to over 15%.

Benefits

Trade offers multiple growth benefits for businesses:

- Eliminates equity dilution

- Removes the need for manual reporting

- Provides instant cash without debt

- Extends company’s runway with no payments for up to 12 months

Integrations

Ratio seamlessly connects with your systems for quick approval and onboarding. It supports various integrations, including:

- Accounting - FreshBooks, QuickBooks, QuickBooks Desktop, KashFlow, ORACLE NETSUITE, Xero, Sage Business Cloud, Sage 50cloud, Clear Books, FreeAgent

- Banking- Plaid

- Payments - Recurly, Stripe, Chargebee, Chargify

Different Tools Offered

Ratio offers a funding comparison calculator that streamlines the process of calculating and comparing different funding options for a customer contract you want to sell.

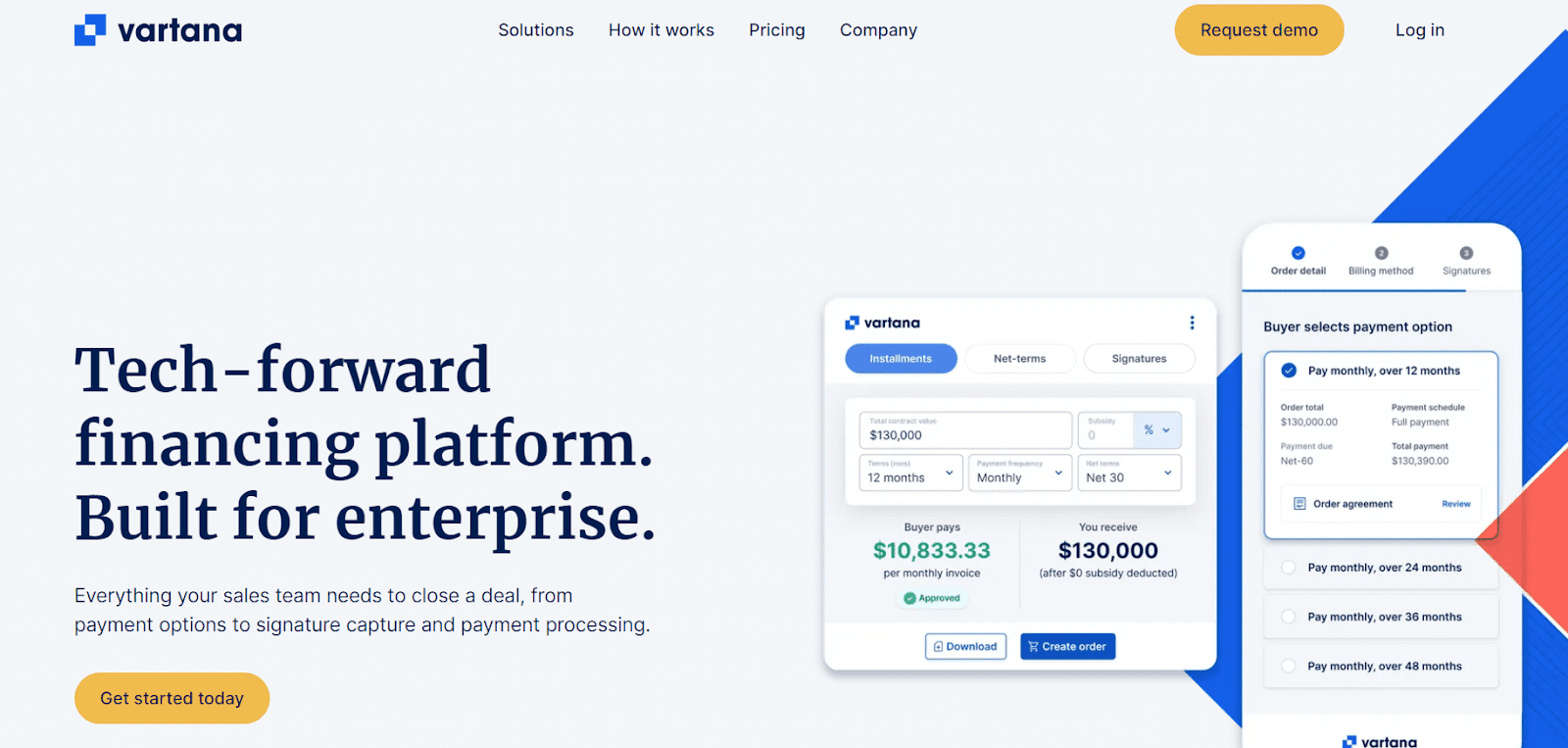

Vartana

Vartana is a finance platform designed to accelerate enterprise sales. Equipped with diverse payment options for signature capture and payment processing—Vartana is a one-stop solution for closing more deals.

Its CRM-integrated app enables real-time financing quotes, manages payment flows, and puts negotiations on autopilot.

Key Differentiators

Vartana’s Capital Marketplace is its key differentiator. The platform uses intelligent algorithms to match loan requests with lenders nationwide for optimum financing.

Furthermore, Vartana takes a data-driven approach to the underwriting process.

Payment Terms

Following are Vartana’s payment terms:

- Businesses can offer their customers monthly, quarterly, Net 15 to Net 120, or full payment options through Vartana.

- Vartana ensures payment transparency by assisting sellers in negotiating and unlocking cash flow.

- It provides three options for payments: full payment, deferred payment, and payment over time.

Benefits

- Reduces default risk for finance teams by maximizing cash flow despite customer payment schedules.

- Boosts collaboration between different teams by allowing them to send, share, and follow-up on orders—all within the app.

- Speeds up deal closure through custom quotes, eSignatures, and real-time updates.

Integrations

Vartana supports various integrations, including Salesforce, Oracle CRM, and Microsoft Dynamics 365.

Different Tools Offered

Vartana offers an ROI calculator that shows how much money you will save using Vartana.

Pipe

Pipe is a capital platform that enables future revenue conversion into upfront capital. Curious how it stacks up? See Ratio vs. Pipe for a side-by-side comparison.

Businesses can access working capital without dilution through secure and live data connections.

Key Differentiators

Pipe differentiates by being a trading platform that connects businesses with institutional investors for contract trading. The platform can be used alone or with other financing options for flexible growth.

Moreover, its algorithm securely evaluates income streams and assesses risk using live data connections.

How Does It Work?

Here is a brief explanation of how the Pipe operates:

- Institutional investors bid on anonymized revenue streams.

- Investors provide up-front capital at a slight discount in exchange for cash rights.

- After signing up, the company receives a trading limit and a bid price.

- Select the trading amount and get the upfront capital on the same day.

- For investors: Pipe provides access to stable yields and built-in diversification.

Payment Terms

Pipe lets businesses trade long-dated revenue streams with investors for upfront cash. Bid prices depend on contract length, payment frequency, and licensee risk.

- Pipe automatically deposits traded funds into your account on the same day.

- If your customers make payments, Pipe automatically withdraws your payments through an ACH.

- You are notified about each payment via the Pipe platform and email. The payment plan you choose to use is based on your traded revenue.

Benefits

- Reduces fundraising time and helps businesses scale quickly

- Boosts margins and manages customer churn, thus helping businesses to focus on loyal repeat buyers.

Integrations

Pipe allows a variety of integration for syncing your systems.

- Billing - Square, Stripe, Recurly, Chargebee, GoCardless, Chargify, PayPal, Apple

- Banking - Plaid, teller

- Accounting - QuickBooks, FreshBooks, KashFlow, ZOHO, Sage, Xero, ORACLE NETSUITE

Different Tools Offered

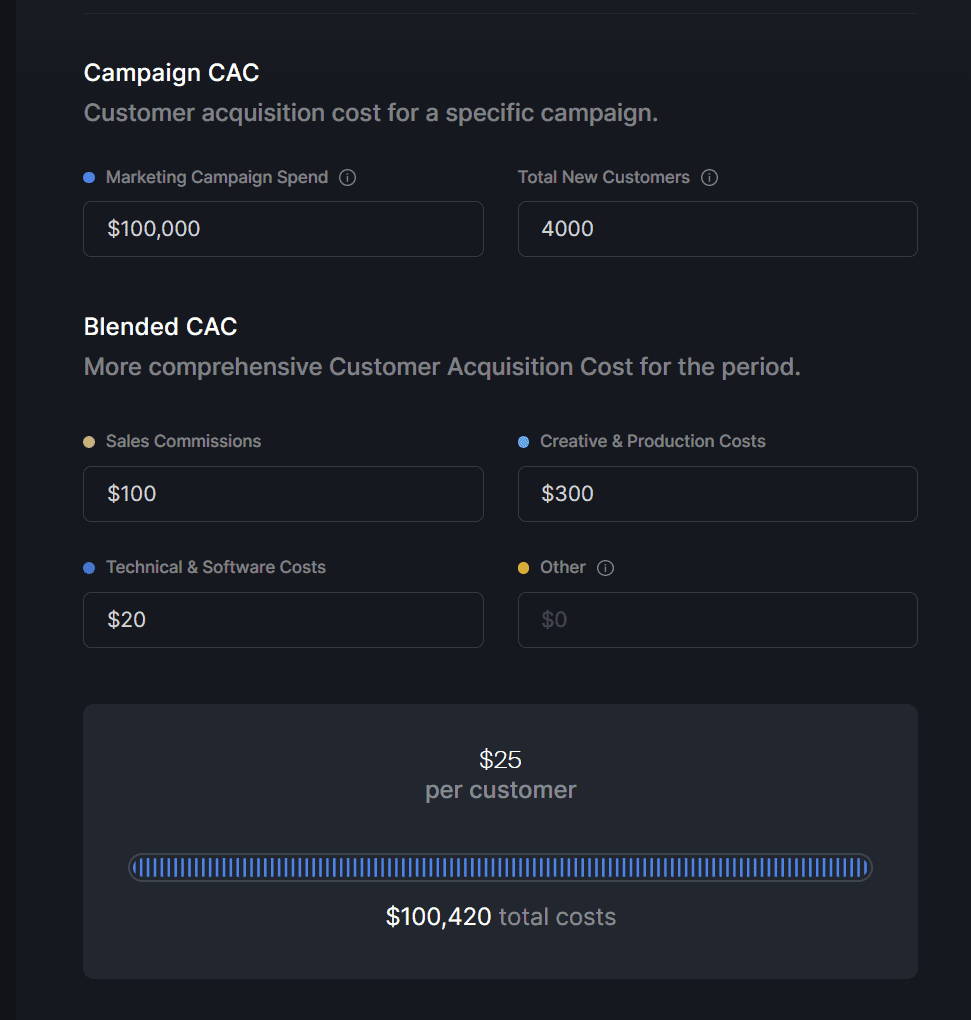

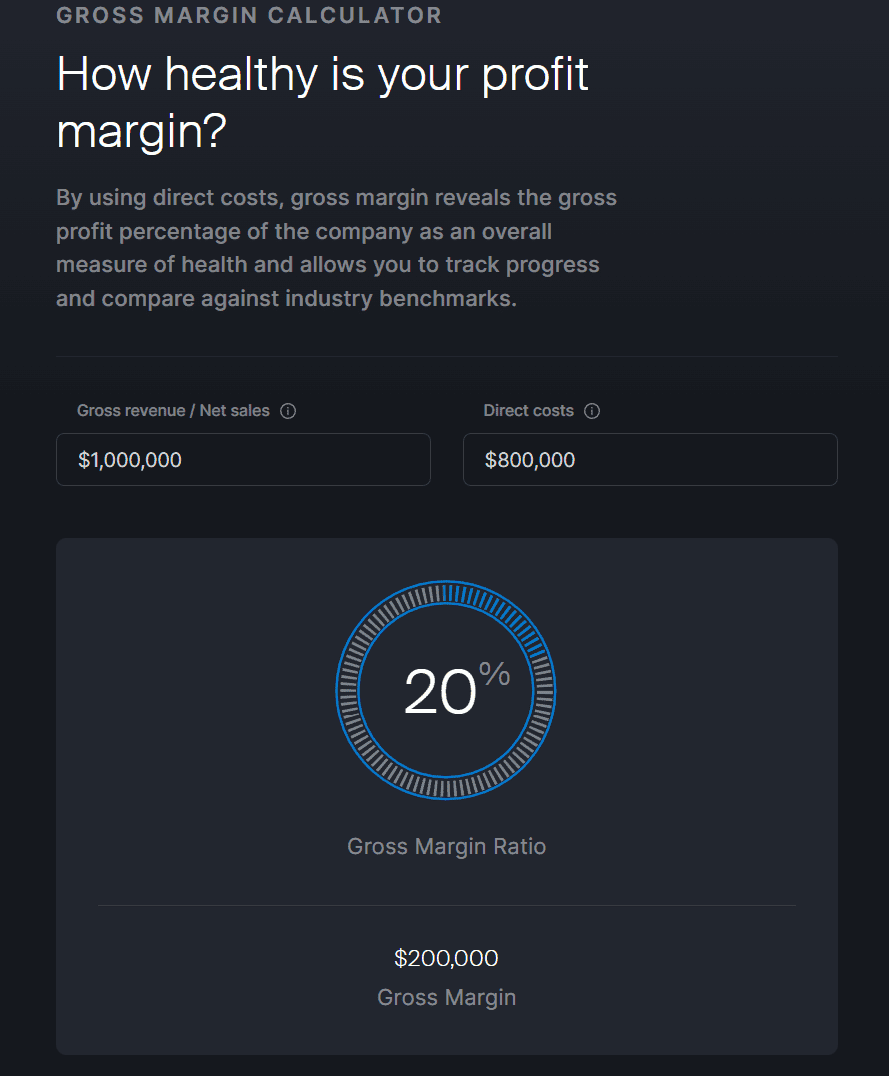

Pipe provides two calculators for your use:

CAC Calculator: Companies use the CAC calculator to determine customer acquisition costs.

Gross margin calculator: This calculator tracks progress and compares against industry benchmarks by using direct costs as a metric for the company's health.

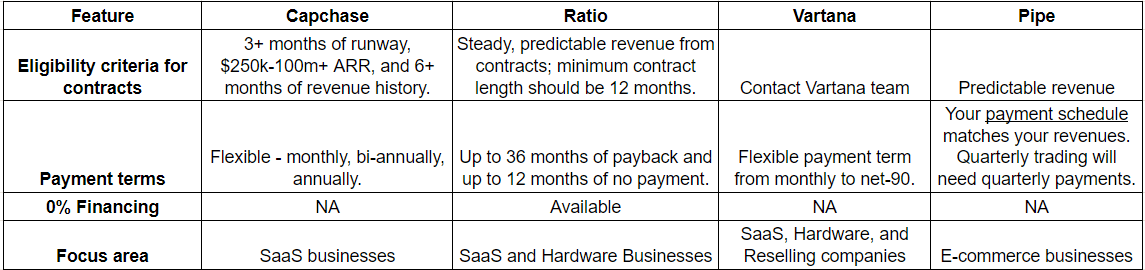

Comparison Of Capchase, Ratio, Vartana, And Pipe

All four RBF providers offer non-dilutive financing, fast funding, no restrictive covenants, and low discount rates.

However, businesses should be aware of key differences between RBF solutions to make informed decisions.

Also, check out this - Ratio v. Capchase, to understand the nitty-gritty of the two solutions..

Ratio - A Promising Choice

Ratio provides RBF through Boost and true sale financing through Trade.

With Boost, it attracts more customers with a BNPL facility while seamlessly integrating into your sales workflow for easier payment management. The flexible financing costs can be borne by sellers and buyers or shared between them, while Ratio bears the underwriting risk.

On the other hand, Trade allows businesses to convert future contracts into instant upfront cash, ensuring stable and reliable capital for rapid growth within hours.

Regardless of whether Boost or Trade aligns better with your business strategy, Ratio is your reliable partner. Their user-friendly interfaces enable your financing requests within minutes.

Unlock growth with Ratio's financing. Register on their app now!

.png)